Auctions Commentary from CCFS Market Analyst Richard Hudson-Evans

As the prices of many, though by no means all classics have increased, and interest rates remain at historic lows, the number of acquisitions funded on finance has risen dramatically. For some time, brokers have been advertising their services in auction catalogues and their reps have been discreetly networking with the punters at sales, and retro-hp has been possible to actually pay for cars that have been knocked down to bidders who prefer to use (or need )other people’s money rather than their own.

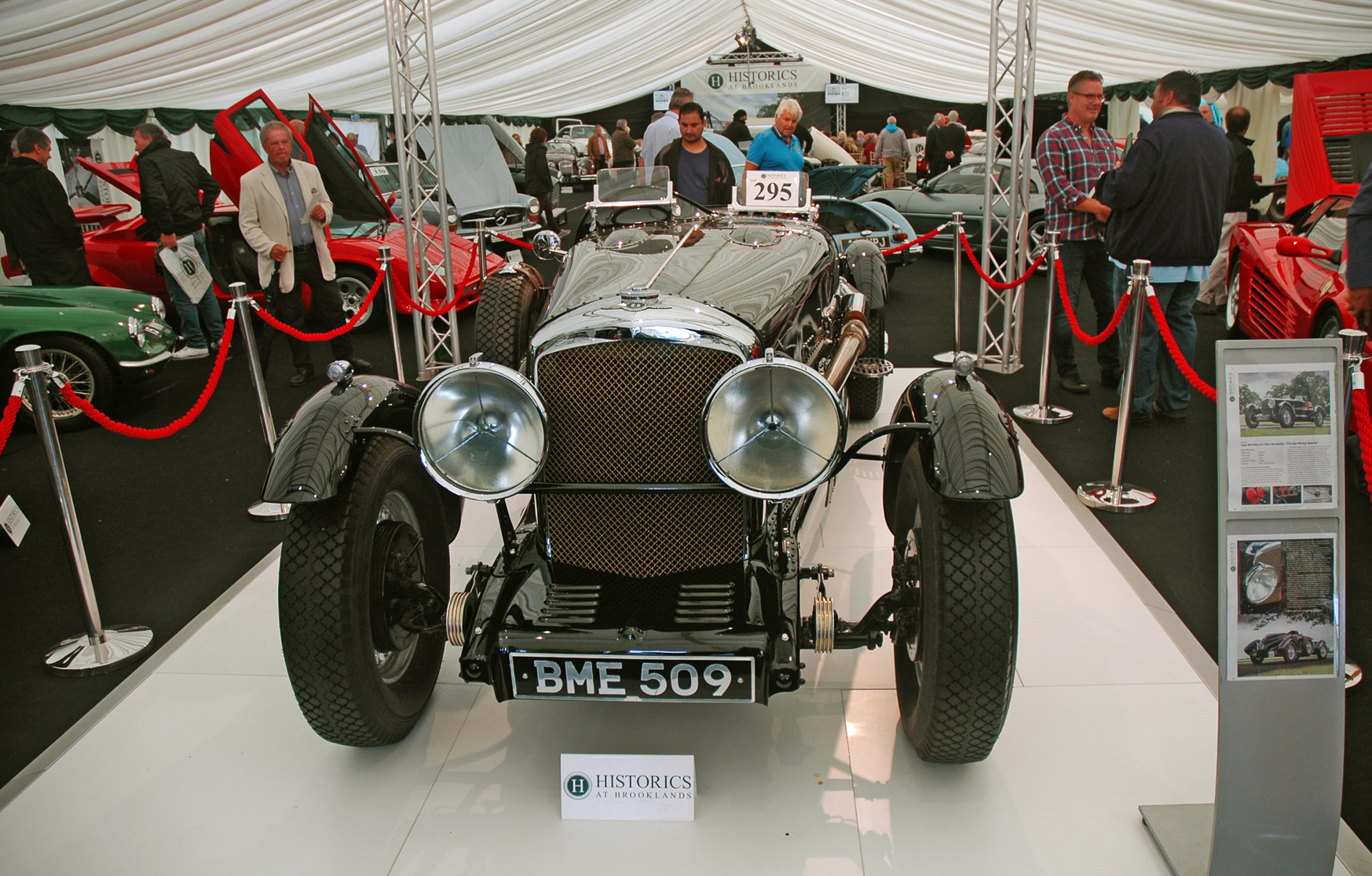

Now, however, Historics at Brooklands have become officially authorised and regulated by the Financial Conduct Authority to offer consumer credit in partnership with Classic & Sports Finance, so that, subject to acceptance checks, their clients can bid away in the knowledge that they have a finance agreement ‘pre-arranged’.

While even more like the trad trade, where virtually all new and most used motors are bought on the drip, a new-fangled web-based interactive finance calculator, embedded with every auction consignment listing in their on-line catalogue at www.historics.co.uk, enables those interested to configure a package that suits their pocket and repayment time scale.

The suits anticipate that most credit-equipped buyers will opt for an hp agreement on a fixed rate of interest (9.6% fixed, as I input this, with an APR of 11.56%). Although, and as has become custom and practice when buying new stuff, other creative solutions such as scarey balloons and the like, are available so that repayment of as much of the outstanding amount can be delayed for as long as possible. All fine and dandy, of course, if prices continue to rise, as they have done for many Ferraris, Porsches and Aston Martins in the recent past, when increased dispersal values have been assured and historic classic car appreciation has taken care of finance charges. But all markets are cyclical and all cyclists will encounter a steep hill eventually and even Olympians on state of the art bikes crash spectacularly!

Although individual credit approval can be set up within 24 hours of an Historics auction, at least five days before is recommended and an impulse buyer certainly cannot expect to arrange finance on the day of the sale. Those bidding for classics on credit must also have an AIP in place, the all-important ‘Agreement in Principal’, which confirms that the lender is willing to lend before the day of the auction and enables a registered bidder with credit approval to bid away up to their limit.

As long as they can afford to buy, native classicists, who might fear credit-cleared overseas invaders armed with much cheaper currency buying up even more of our automotive heritage, will be relieved to hear that pre-financed buyers will need to be domiciled in the UK and have a permanent UK address that checks out.

On behalf of rare consumers who prefer and are able to spend their own money, and who may be fearful of competing against financed opponents, I have also been assured by Historics’ Auction Director, Edward Bridger-Stille, that the auction company will not know how much any registered bidder with an AIP from Classic and Sport Finance is good for - thus avoiding an auctioneer from running the financed bidder up to his pre-arranged spending limit!

While gratification may well be relatively instant for those who will buy classics on the tick, by end of term, borrowers will, of course, have paid considerably more for their toys than those bidding with their own old money. The vast majority of properties and their contents, jets and commercial vehicles, most private cars and their running costs, and nearly all lifestyle purchases, have been paid for with borrowed money for yonks. Maybe fellow luddites who pay hard earned taxed cash for Real Ale rather than bending the plastic or swiping their mobiles in order to consume the cheapest goods may have to adjust to even more change.

Although if the finance trend does really catch on or even become the norm in the old car bizz, then the prices of all £10k+ classics will almost certainly rise as a direct result of the influx of external funding – and only a return to a softer market or even the return of ye olde bear pit is likely to frighten away the new breed of brave young bulls with their AIPs.